https://youtu.be/C4X-wgWcn9E?si=5dGQTrWJFzOwzmqQ

The National Savings Average in the United States is currently 4.6% as of January 2025, up from 3.5% in December 2024 according to the The Bureau of Economic Analysis (BEA). That said, to truly build "wealth", it is estimated that you should be saving about 20% per year of your take home pay. This is a combination of both pre-tax and after tax strategies based upon your economic status (Please consult your tax adviser on how best to maximize your tax savings).

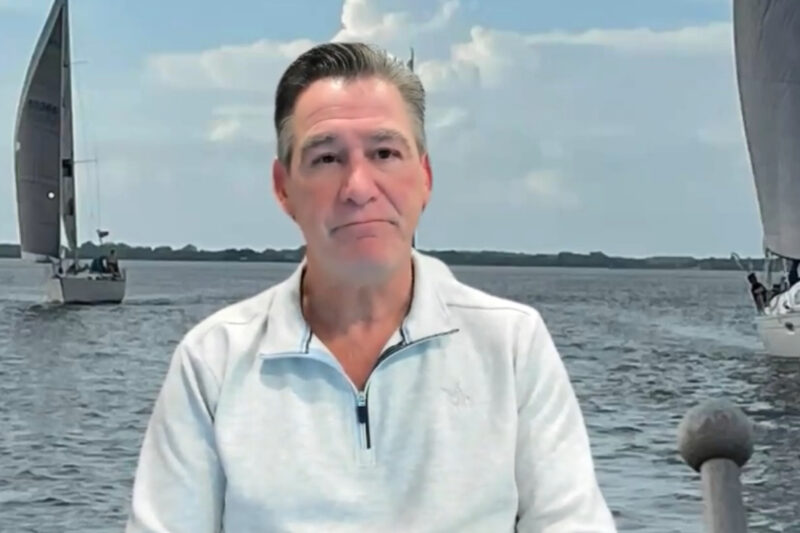

In this episode we bring David Mozeika, a lifelong financial advisor who started right our of college helping his clients build wealth, on to talk about the psychology of saving first, then spending. His software program called Currence, is changing the way people save. So much so, that his users are saving almost SIX TIMES the national average.

Take a few minutes and check out his stuff. And if you want to load the program for yourself, please use this form to register.

https://youtu.be/iaauDbaRHa8

It's the beginning of December, and as a business owner, timing your deductions to match your revenue, is at the top of your goals that we here from our clients. In this episode, I quickly cover some of the deductions that you should think about both before, or after, the end of the year. If you haven't set up your "Perfect Plan", now is the time.

We are thrilled to have Tom Hegna, past Senior Vice President of New York Life's Annuity division on to discuss how to Retire Happy, regardless of your age. In the Third Episode, Tom gives you insights into what you should do, when you should do it, and what PRODUCTS, you should have to retire HAPPY.

P.S. If you want to learn more for your specific situation, click on the form to the right to have your "Perfect Plan" designed based upon your goals.

https://youtu.be/jQ7xGYpVHp0?si=yOWXs1To9Ba6N8yy

#RetireHappy #PerfectPlan #Income #IncomeAnnuity #Annuties #LifetimeIncome

You've heard the saying, "Buy Term and invest the difference, right?" Well, in this clip, Tom Hegna explains the BASICS about Whole Life Insurance. When combined with other tax strategies, as well as a Long Term Care Rider which is now a "standard" rider that EVERYONE should add to your policy (if old enough), it becomes an Asset that you can use your WHOLE LIFE.

If you are in your 20's, the concept is compounding. A life insurance policy purchased when young, can do the following:

- Tax Deferred Growth of your money

- Lifetime Insurance Protection

- Guaranteed ability to purchase MORE every few years (without a medical exam)

- Provide a Long Term Care Benefit

- Placed in a trust for "special needs" care of an individual

- Used as a Buy/Sell in the future

- Buy a house and use the cash as a down payment (with repayment to yourself)

- Depending on the product, may also have guaranteed lifetime income (depending on carrier).

In this video, Tom Hegna discusses what an Income Annuity is. How it acts likes Social Security or a Defined Benefit Pension. And why you must have this in your portfolio as part of your "assets' in retirement, regardless of how much you have.

At Schiff Benefits Group, we help business owners and their key employees create streams of income in retirement that can't be found by just using your IRA to draw income. At the same time, we protect against a downturn in the market, a long term care event, and a death of your spouse in retirement. Send us an email or call us to learn more.

Ever wanted the "perfect" plan where the company gets a current deduction when the money is paid into the plan, the cash grows tax deferred, and then the participant get the money "tax free"? Well look no further. There is a plan like that available. You just have to be willing to discriminate.

It's called a Restricted Executive Bonus plan and combines to different benefits in one. It has to be done carefully to meet IRS guidelines, but is 100% legal. Nice thing is, it's not carrier or product specific, and has the flexibility as to what type of asset you want in the plan.

To learn more, give us a call or check out our Executive Bonus material. We'd be happy to design a sample for you so that you keep your best people.

Micki Hoesly, CLU, ChFC,

entered the financial services business 34 years ago with Mutual of New York, which is now part of AXA Advisors. In 1983, Micki began her own company, Capital Resources, specializing in pensions. Micki is also principal of Resource 1, a registered investment advisory firm. She is a 32-year Qualifying and Life member of the Million Dollar Round Table (MDRT) with three Court of the Table and eight Top of the Table qualifications. She also currently serves as the association’s second vice president. (Investment advice through Resource 1 Inc. Securities offered through Ceros Financial Services Inc. — not affiliated with Resource 1 Inc. Member FINRA/SIPC.)

Stephen O. Rothschild, CLU, ChFC, CRC, RFC,

is president and owner of M21 Consulting in Scottsdale, Ariz. His organization works exclusively through and with the high-net-worth and business clients of independent registered investment advisors, independent broker dealers and a few other financial professionals. M21 Consulting does not solicit clients directly. Stephen also has a long history of industry leadership. He is a Life and Qualifying Member of the MDRT and holds numerous Top of the Table and Court of the Table qualifications. He served as MDRT president in 2006-2007. Stephen also has served on the board of directors with both the International Forum and the AALU.

Matthew E. Schiff, CLU,

is the president of Schiff Benefits Group, specializing in the design, implementation, financing and ongoing administrative support of supplemental executive benefits programs. With more than 20 years of experience in the financial services industry, he is recognized as a leader in the deferred compensation field. Matthew is a Lifetime Member of the MDRT, with nine consecutive Top of the Table distinctions.

I’ve been a part of the life insurance business for the past 30 years, and like a lot of industry veterans, I’ve seen my share of change. A lot of the more experienced agents back in the early 1980s used to tell me — a newcomer at the time — that the business had shuffled along at a fairly slow pace until universal life burst on the scene. That single product brought an era of change and challenges, and although UL is now viewed as a traditional product, it seems like the business is still living in that era of rapid change.

At the risk of stating the obvious, though change is often difficult, it’s clearly not all bad. Whether change is good or bad for producers depends much upon how the producer integrates new developments into his or her business, and how willing he or she is to look beyond the immediate challenges toward a more successful future.

The best producers do just that, and for this month’s roundtable, we are asking some of the most talented, most forward-thinking and most articulate producers around to share their thoughts on the future of our business. No doubt we face some real challenges. But the future also provides some tremendous opportunity, and we’ve asked the following panel to share their thoughts on just what lies in store: Micki Hoesly, CLU, ChFC; Stephen O. Rothschild, CLU, ChFC, CRC, RFC; and Matthew E. Schiff, CLU.

Question 1

Charles K. Hirsch, CLU: There continues to be a tremendous focus in the life insurance business on the boomer market. That seems sensible when you consider the financial needs of the large number of people in that age group. But it also makes one wonder whether the business may be neglecting the needs of other demographic groups — like Generations X and Y. What are your thoughts on that?

Micki Hoesly, CLU, ChFC: There seem to be several logical reasons for the current focus on boomers. First, the boomers are now in the pre-retirement and early retirement years, which are critical times in their financial lives. Additionally, the average age of advisors has been getting much older, meaning that many of the advisors are also boomers.

It wouldn’t be surprising for their focus to be on people of their own demographic. There is also the wealth of the boomers’ parents’ generation, which is beginning to transfer, prompting an even greater need for financial advice.

But I don’t believe that Generations X and Y are being ignored. Every professional meeting I attend has information-packed sessions about how advisors can meet, communicate with and serve the X and Y generations. There are also sessions on how Gen X and Y advisors can meet, communicate with and serve other generations as well. I believe that advising Gen X and Y offers a great opportunity for advisors to build multigenerational practices so that the wealth built by each previous generation is preserved through their children and their grandchildren.

We can do that by either strategically making multigenerational planning with specialized products and services for each generation, or we can do that by apprenticing X and Y generation agents with our boomer agents to create multigenerational practices serving multigenerational families.

Stephen O. Rothschild, CLU, ChFC, CRC, RFC: Our industry has aged, and it is only natural to work with prospects close to your age. I worked with boomers before the name existed. Sadly, we do not have enough younger agents to work with their own age group, like Generations X and Y. Thus, it is not neglect but lack of younger entrants in our industry. As Generations X and Y age, they will get more attention paid to them as they will earn more and inherit more. They are also being addressed in some non-traditional ways. They are more likely to buy over the Internet, through worksite marketing, and through agents who have set seminar methodologies that address their market and needs.

Matthew E. Schiff, CLU: The insurance industry, as well as the professionals in it, has always looked at the demographics of a population and tried to focus its energy on the largest population. In this case, the baby boomers have been, and probably will be, the industry’s focus for the continued future because it’s the largest demographic. This does leave the under-45 market underserved, and I believe that the best way to help those in this market is by fostering the hiring of financial advisors under that age who can relate to their peers.

Question 2

Hirsch: Some companies and some producers are doing a lot of work in various ethnic markets. Is this a trend that makes sense to you, and do you see it continuing? Where do you believe we are headed in the area of serving the financial needs of specific ethnic groups?

Rothschild: Those addressing the various ethnic markets are simply following demographics. Population trends and birthrates show the ethnic markets are growing at a faster rate than the non-ethnic markets. The same logic applies to entrants into our business, as new insurance agents will often address their own ethnic market.

Schiff: This is not a new trend. New York Life prides itself in its ethnic marketing and has for many years. Their company, like many others, is focused on diverse markets. It’s just that, to be effective in those markets, just like any specialty, it takes time to establish a reputation and a presence in the specific market.

As for where we’re headed, the industry as a whole in the United States has to hire more diverse agents. Carriers that develop career agents understand that. But because of the drop in new agents over the years, it may be difficult to have a large impact in ethnic markets.

Hoesly: Many top-producing advisors have built practices that strategically focus on one market or one client demographic. Narrowing the focus allows the advisor to completely understand the needs of that market and become a recognized expert. With the United States becoming increasingly diverse, it makes sense to serve the needs of a defined demographic and provide specialized services that are specific to that market. This could be based on ethnicity, on age, on the type of business or those who need a certain type of service.

Question 3

Hirsch: When you look around at the competition these days, it seems there are more sales coming from or through non-traditional sources — like banks, the Internet, etc. Is this type of competition something that producers should fear? Or are there good ways to partner with these non-traditional sources to benefit everyone? And looking even further ahead, what type of competition do you believe has the potential to negatively impact the producer’s business to a significant degree?

Schiff: No. “Insurance is a product that is sold, not bought” is a well-known anonymous quote that describes our product. If agents get concerned that the commodity portion of our products are being sold through different channels, then we as agents have brought no value to our clients.

To partner with the non-traditional channels, you need to be a specialist at what you do, like a doctor (OB/GYN, orthopedist, family doctor, etc.). This brings value to them where they don’t normally have the expertise. But in my 21 years in the insurance industry, the only thing that can negatively impact the potential sales of life insurance is not competition, but rather legislation.

Hoesly: There is more need for life insurance and financial advice than our current advisors have been able to reach. Offering good products and services and reaching more people and encouraging them to take hold of their financial lives makes us all better. I don’t believe that producers should fear alternative distribution as long as it is reputable and builds on the good character and values of putting clients’ needs first.

The risk I see is competition that is deceptive, products that are financially unsupportable, or companies that put the guarantees of the industry in question. I think the greater risk today is the onerous disclosures and restrictions on advice that make it difficult for clients to understand their options and sift through the complex array of products and strategies. It seems backwards to me that the more licenses one holds, the more the advisor is restricted in how he or she can communicate and advise clients. Often, procedures appear to be primarily driven by the need to defend and not by the need to inform.

If we lose sight of our primary purpose — helping the client do what is in his or her best interest — then our service loses its value.

So where do I see future competition? I see it coming from the bold firms that believe clients need advice and that are not fearful of having that advice subject to fiduciary standards. I see it coming from advisors who understand that clients are overwhelmed with too much information and that a valuable service we provide is helping them find which information is significant and meaningful to them.

Rothschild: Producers who have not grown or changed should have great fear. Competition is coming from banks, registered investment advisors, broker-dealers, casualty brokers, accountants and a few attorneys. Many life producers have entered some of the competitors’ arenas as well, particularly in the investment arena. The key is your ability to differentiate yourself.

Frankly, most life producers are being commoditized, just like the insurance carriers. If you hold up two ledger statements from two different carriers, they look the same. Unfortunately, the prospect will determine value by looking at the premium and as we all know…

This analogy applies to the producer as well. Being a trusted advisor is no big deal. Rather, it is just table stakes. Is a prospect going to work with someone they don’t trust? Becoming the most-valued advisor is what is important. How is the advisor bringing value to the prospect? Are you leaving it up to the prospect to determine the parameters of value? Or are you helping them determine these parameters?

At our firm, M21 Consulting in Scottsdale, Ariz., we work primarily with independent registered investment advisors and independent broker-dealers. We do not go after the retail market directly. We bring our expertise to those who want to deepen their client relationships and diversify and increase their revenue. Their high-net-worth clients are our target.

Other producers can partner in other ways, or others can partner with life producers. It depends on who is doing the marketing. I am never concerned about a negative impact on the producer’s business, as there are still way too many prospects who are never called on or do not have a life insurance advisor. Again, those who don’t make changes to their practice will find themselves out of the business.