If you are a business owner or decision making executive, how would you want to design The Perfect Plan™ to retain and reward your employees? A 401K is terrific for basic retirement savings, but there are limitations to how much you can put in, and it must be given to everyone on a proportional basis.

In this episode, we discuss the decision making process, how you can get the perfect timing of your deductions, and include the people and benefits that are needed most, in the most tax efficient manner. No two companies are alike, and neither should your plans be.

Come and listen to this podcast as we lay it out for you.

https://youtu.be/C4X-wgWcn9E?si=5dGQTrWJFzOwzmqQ

The National Savings Average in the United States is currently 4.6% as of January 2025, up from 3.5% in December 2024 according to the The Bureau of Economic Analysis (BEA). That said, to truly build "wealth", it is estimated that you should be saving about 20% per year of your take home pay. This is a combination of both pre-tax and after tax strategies based upon your economic status (Please consult your tax adviser on how best to maximize your tax savings).

In this episode we bring David Mozeika, a lifelong financial advisor who started right our of college helping his clients build wealth, on to talk about the psychology of saving first, then spending. His software program called Currence, is changing the way people save. So much so, that his users are saving almost SIX TIMES the national average.

Take a few minutes and check out his stuff. And if you want to load the program for yourself, please use this form to register.

Non-Traditional Long-Term Care Insurance Alternatives

Long-term care (LTC) is a significant concern for many clients, especially with the high costs associated with services. Traditional long-term care insurance (LTCi) can be appealing, but its "use-it-or-lose-it" structure is often a deterrent for those hesitant to commit. At Schiff Executive Benefits (SEB)

, we understand that different clients have different needs, and sometimes, a creative solution can provide the protection they need without the drawbacks of traditional LTCi.

With the cost of LTC services ranging in the tens of thousands annually, it’s no surprise that many Americans struggle to feel confident about their ability to pay for such care in the future. Approximately one-third of individuals aged 65 and older express concern over their financial readiness for potential long-term care needs. Offering alternatives to LTC coverage can help alleviate this worry and provide both peace of mind and financial savings.

Below, we outline four alternative options that can serve as practical solutions to the standard LTCi policy.

1. Short-Term Care Insurance (STCi)

For clients who either can’t afford traditional LTCi or may not qualify, short-term care insurance (STCi) offers a practical alternative. In fact, nearly half (49%) of long-term care insurance claims last one year or less, according to the American Association for Long-Term Care Insurance. This is precisely the type of care that STCi covers, making it a smart choice for many clients.

STCi plans typically offer coverage for a limited time frame (up to one year) and are often available at lower premiums than traditional LTCi policies. STCi also provides more lenient underwriting and higher issue ages (some plans available up to age 89).

- More affordable premiums compared to traditional LTCi

- Flexible funding options (CDs, savings, IRAs)

- Return of premium option — clients can recover their investment if the policy is surrendered

- 0-day elimination period in many cases

- Less stringent underwriting

2. Annuity/LTCi Combination Products

Annuity/LTCi combination products provide a unique solution that combines the benefits of an annuity with long-term care protection. These asset-based solutions allow policyholders to use the accumulated value of an annuity to cover LTC expenses. What makes this option particularly appealing is that any gains used for LTC are tax-free, and "part" of an IRA or 401K can be used to fund this through a tax-free rollover.

In the event that the policyholder doesn’t require long-term care, they can either leave the remaining value of the annuity to a beneficiary or continue to use it as they see fit.

Key Features:

- Single-premium product that can be funded with existing assets

- Minimal underwriting required

- Can cover multiple lives (e.g., a couple)

- Offers a continuation of benefits rider (extend LTC benefits even if the annuity value is depleted)

- Available as fixed or indexed annuities, immediate or deferred

Learn more about annuities and their role in financial planning.

3. Life Insurance with LTCi Combination Rider

Life insurance policies that include long-term care (LTC) riders combine the benefits of life coverage with the flexibility to access death benefits for LTC expenses. This provides policyholders with dual protection — a safety net for their loved ones after passing, and the ability to pay for LTC if needed.

What’s more, if LTC isn’t required, the remaining death benefit can be passed to the beneficiaries tax-free.

Key Features:

- Single, limited, or continuous premium options

- Return of premium available upon policy surrender

- Inflation protection rider available

- Can cover two lives (spouses)

- Requires streamlined or full underwriting, depending on health

- Ability to convert existing life insurance policies to a life/LTCi combination through a 1035 exchange

Learn more about life insurance with an LTC rider through the National Association of Insurance Commissioners (NAIC).

4. Life Insurance with Chronic Illness or LTC Rider

For clients who are not interested in a full life/LTCi combination product, adding an LTC or chronic illness rider to a standard life insurance policy could be the ideal choice. Both riders allow policyholders to access the death benefit to cover qualifying LTC expenses, either at home or in a care facility.

This option is particularly flexible because, if LTC isn’t needed, the policy’s beneficiaries can still receive the death benefit.

Key Features:

- Multiple premium options

- No return of premium option, though the policy’s cash surrender value may be accessible

- Premiums are protected from rate increases

- Full underwriting required

- Ability to convert existing life policies (not annuities) using a 1035 exchange

For a deeper understanding of chronic illness riders, visit The American Council on Aging.

A Forgotten Tax Deduction:

Lastly, it should be note, Long Term Care Premiums can be deducted on Schedule A (form 1040), Itemized Deductions, or the self-employment health deduction and the following table apply to the deductibility for 2024 Tax Year:

- Age 40 or under: $470

- Age 41 to 50: $880

- Age 51 to 60: $1,760

- Age 61 to 70: $4,710

- Age 71 and over: $5,880

Why Schiff Executive Benefits(SEB)?

At Schiff Benefits, we understand that no two clients are alike, and neither are their long-term care needs. By offering a variety of options — from short-term care insurance to annuity/LTCi combination products — we help clients find the best solution tailored to their situation. We focus on providing flexible, cost-effective alternatives to traditional LTC insurance, ensuring that your clients have peace of mind without compromising their financial future.

Contact us today at info@schiffbenefits.com to discuss the best LTC solutions for your clients.

https://youtu.be/jKzJWj8SbRQ

Are you a fan of Arli$$ the TV Show? Do you remember what the premise was? It was about a glitzy sports agent played by Robert Wuhl who is in the big-money world of professional sports and entertainment, playing the eternally optimistic and endlessly resourceful L.A. sports agent Arliss Michaels, whose Achilles' heel is his inability to say "no" to clients and employees.

In this episode, we have the pleasure of sitting down with the man that the show was based off of, Dennis Gilbert of Paradigm Gilbert (a Higgenbothom Partner), as he goes into how Bobby Bonilla came about, what it was like to get started in the insurance industry, his stint in baseball and how he brought his passion for the game together with the financial services world.

https://youtu.be/9TXKfikwC8I?si=9qWoXfldUdd3RSpt

In 2024, we launched The Perfect Plan™ Podcast. We brought on so many great guests, who shared their knowledge on many topics. In this first episode of 2025 we review last year's content, and then focus on what YOU need to know in 2025.

Do you know all of the "Business" deadlines for your business in 2025? Have you thought about implementing a retirement plan, or making contributions for 2024 before you file for your taxes? These are just TWO of the items that we discuss and cover January to December the things you should know.

#taxplanning #taxdeadlines #taxefficient #2025finances #finances #financialeducation

https://youtu.be/iaauDbaRHa8

It's the beginning of December, and as a business owner, timing your deductions to match your revenue, is at the top of your goals that we here from our clients. In this episode, I quickly cover some of the deductions that you should think about both before, or after, the end of the year. If you haven't set up your "Perfect Plan", now is the time.

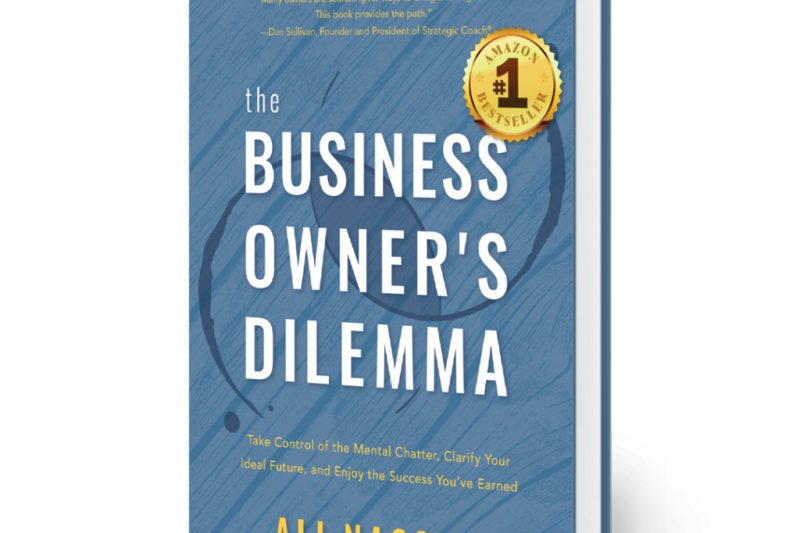

In my latest interview with key people in the financial services world, I had the pleasure to hear from my friend Ali Nasser as he explained his history of working with business owners and their "dilemmas". We chatted about our friendship, history, and how he decided to write his book where you'll learn that you aren't alone in how you run your business, what you prioritize, and what you think about. He has spoken nationwide about this topic, and you can learn more by accessing his book through this link:

If you'd like to purchase his book, please use the following link:

https://www.amazon.com/Business-Owners-Dilemma-Control-Chatter/dp/1544501463

Through his stories, he'll help you gain clarity of what is most important to you, and help you lay out a plan for your "ideal" situation.

P.S. SEB does not make any money on the sales of this book, and 100% of the proceeds from his book go to Charity (Water). We hope that you enjoy what it offers you, and that if you find value, we would be happy to help you Clarify your ideal Future.

As a financial advisor of over 34 years, where I grew up at the kitchen table listening to BOTH of my parents discuss their day at work, I learned the “basics” of finance at a very young age. Some would even say, “he couldn’t run fast enough to get away from it”.

So how can the knowledge shared over the kitchen table by two of the smartest financial people I’ve known in my life help you? Well, first off, if you haven’t had the chance to listen to “The Perfect Plan” podcast on YouTube hosted by Matt Schiff and Schiff Benefits, then you have missed out on incredible “wisdom” from financial services industry wizards from all sides of the financial services world. Hear from experts like:

- Tom Hegna (Former SVP of NYL Annuity Division)

- Jamie Hopkins (Preisdent of Bryn Mawr Trust Advisors)

- Joe Jordan (Living a Life of Significance Author)

- Bud Schiff (Managin Director Alvarex and Marsal)

- Dan Zugell (SVP of BTA Advisors)

- Lindsay Hanson (VP of JH Vitality)

- Ali Nassar (Business Person's Dilemna)

https://www.youtube.com/@SchiffExecutiveBenefits/videos

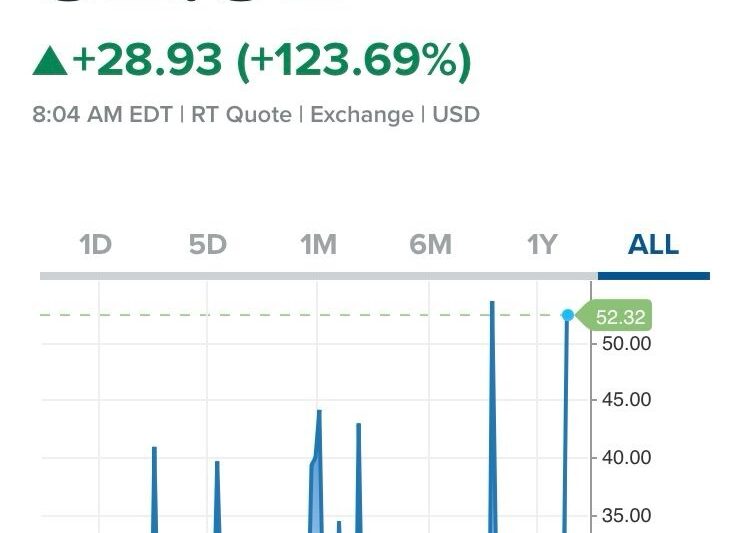

But forget the podcast, if the market is down 5% - 10% in the last week… I am running around like Chicken Little – Protect Me. Your retirement assets are at risk, you may be close to, or in retirement, and can’t afford a market downturn with a POTENTIAL recovery. You need income, you need security, and a correction has a material impact on you. How can I LOCK IN my value today, the income potential, while also getting upside potential? Questions, more questions, and where can I find the answers?

So, what should I do? Sell? Buy and hope that I caught the bottom? Truth is, it’s not the investors job to TIME the markets. At the same time, you shouldn’t “blindly” give money managers money. But is SHOULD be aligned with being able to put your HEAD ON THE PILLOW every night, and being able to sleep comfortably, no matter if it goes up or down.

At Schiff Executive Benefits we aren’t market timers. We don’t claim to know one industry over another, or say you’ll get X amount of return. What we DO KNOW is that after a combined 80+ years of experience, we listen to what you want to accomplish, formulate a plan, and help you execute it with a formal review to stay on track. There are ways to PROTECT your downside market risks while also participating in the upside potential, both in pre- and post-retirement years. It all depends on your risk/reward levels. A younger individual can afford more risk and as you get older, you should try to manage that downside risk, with strategies that FIT YOUR GOALS. Let SEB help you define and achieve your goals.

If this aligns with your feelings, goals, and risk strategy, then email us at info@schiffbenefits.com to start your journey. Our advisors will help you create a strategy with YOUR goals in mind.

#StockMarket #Retirement #Alternatives #Income #Protection #Goals #HeadonPillow

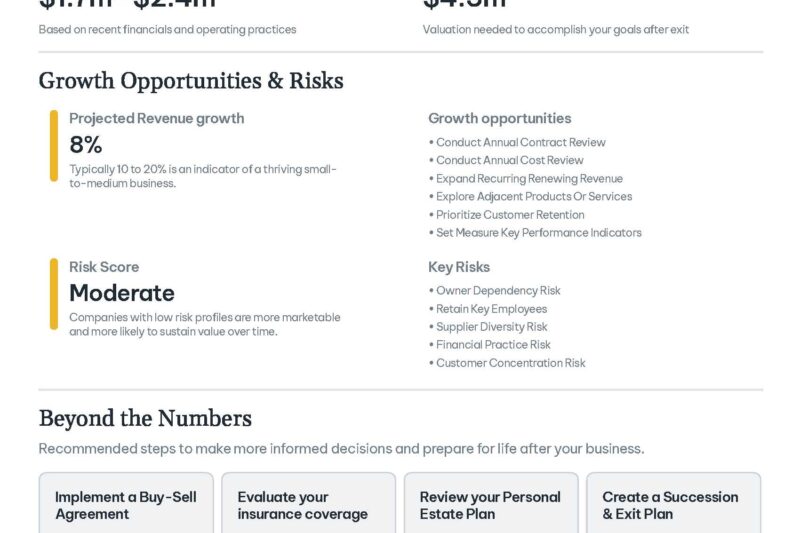

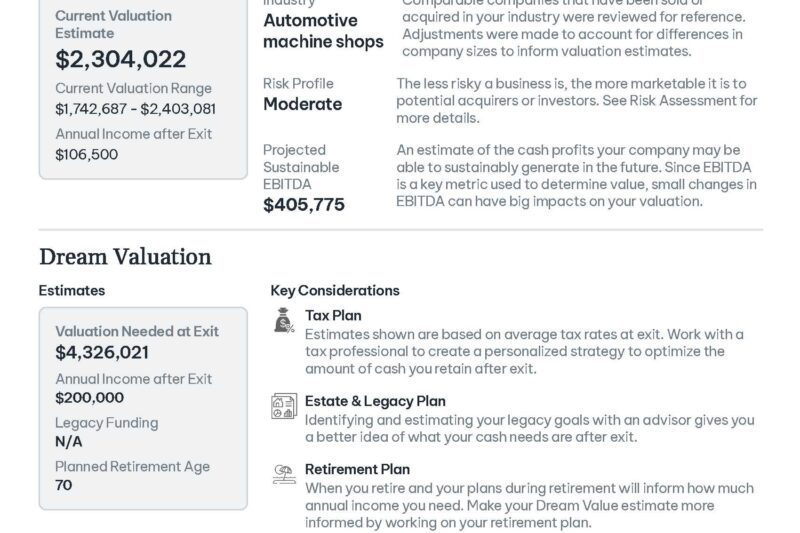

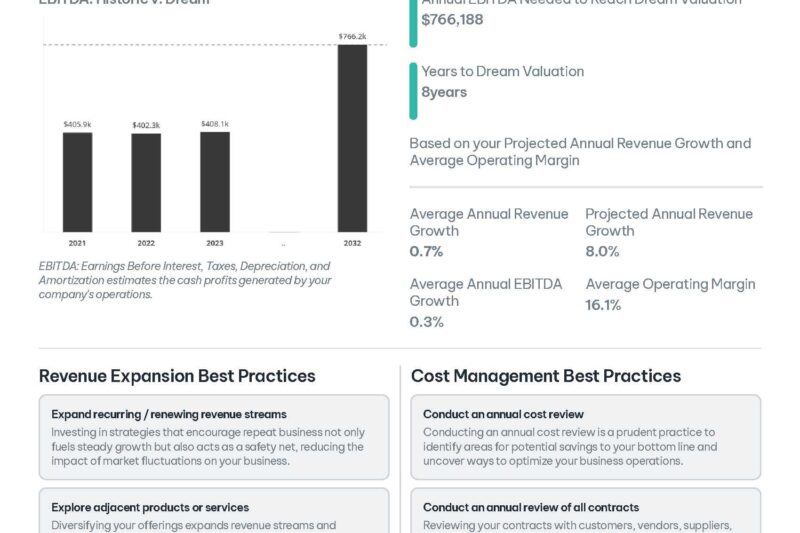

Every business owner starts their business with the intent to "sell it" sometime in the future, make a lump sum, and walk away. Most likely, if you are reading this, you're more than far enough along in your ownership journey that you are now asking yourself:

"How much is my business worth?".

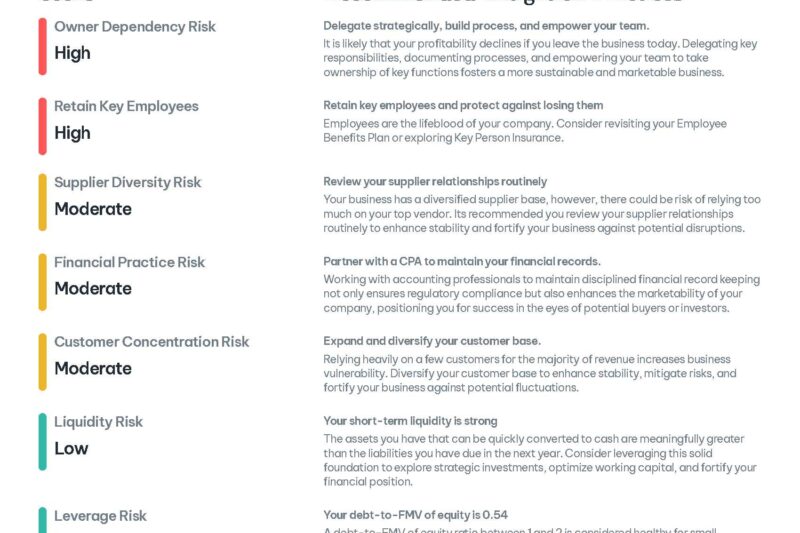

At Schiff Executive Benefits (SEB), we use a business valuation program called RISR that can help you find out. If you use Quickbooks, an owner can share their last three years of tax related data electronically, seamlessly, and securely through a link that we will send you to your PRIVATE valuation. After uploading that data, and answering a few questions about the operation of the business (i.e. ownership, tax structure, client concentration, operational questions, etc.), RISR will generate a SNAPSHOT value for SEB to review with you, so that you can realize your DREAM value in the future.

Using the results from the report, you can:

- Negotiate offers with potential buyers,

- Discuss with management ways to improve profitability

- Review potential business valuation risks, and

- Align your people with the future growth of the company.

Here were some of the solutions that our clients decided upon after engaging SEB:

- Sold to an outside party

- Implemented an Installment (structured) sale to the employees/family member

- Employee Stock Ownership Plans

- Sell some or ALL of your stock

- Retain Control of the company

- Immediate Tax Savings for an S Corp

- Provides Retention Strategy for ALL employees

- Buy/Sell Planning Between Partners upon:

- Death

- Disability, or

- Retirement

- Tax Efficient Retention Strategies

- Executive Bonus

- Restricted Executive Bonus (REBA)

- Supplemental Retirement Plan

- Excess 401K Plans

- For YOUR report specific to YOUR company, Complete the form below to request your link for your business valuation.

A FULL sample report can be downloaded here: Schiff Auto report

https://youtu.be/VUsv8NaXsrc

Are you a business owner? Have you ever thought about selling your business? How much is it worth? Do you have other shareholders, or family that own part of the business?

Well, in this, the Sixth episode of The Perfect Plan, Dan Zugell, my friend and colleague of 25 plus years goes into the wonder of an Employee Stock Ownership Plan (ESOP). In this qualified retirement plan solution for a business owner, you have a ready and willing buyer, that will buy your business, for a set dollar amount, at a set triggering event. If done correctly, you as the business owner can still run it, control it, and participate in the future growth of your company.

Dan goes into the benefits, tax advantages, and rules of how to design "the perfect" exit strategy for the closely held business owner. Take a few minutes and hear what he has to say, then contact us on how we can help you monetize your largest asset.

Ps. You can schedule a direct call with Dan at https://dantheesopman.com/ or with SEB at Calendly - Matthew E Schiff