https://youtu.be/AL7y2y9KpVY

Are you a business owner who is a family man/woman and worried about how to protect yourself from all things financial? Well, in this episode, our guest Jay Judas shares his years of experience working with Business Owners, Life Insurance Carriers, and High Net Worth Families and some of the things that you should know about such as Offshore Assets, International Travel, Living Abroad, and the strategies to enjoy that lifestyle.

https://youtu.be/xCJa6nq6qb8

Are you a Business Owner? Are you an accountant who works with business owners? Are you trying to figure out how much your business is worth, or better yet, are your trying to plan your exit strategy?

Then you want to hear from Jason and Corey about how RISR can help the business owner monetize his/her largest asset.

If you'd like to know your business value, click below to start your Business Valuation:

Start your own Business Valuation here

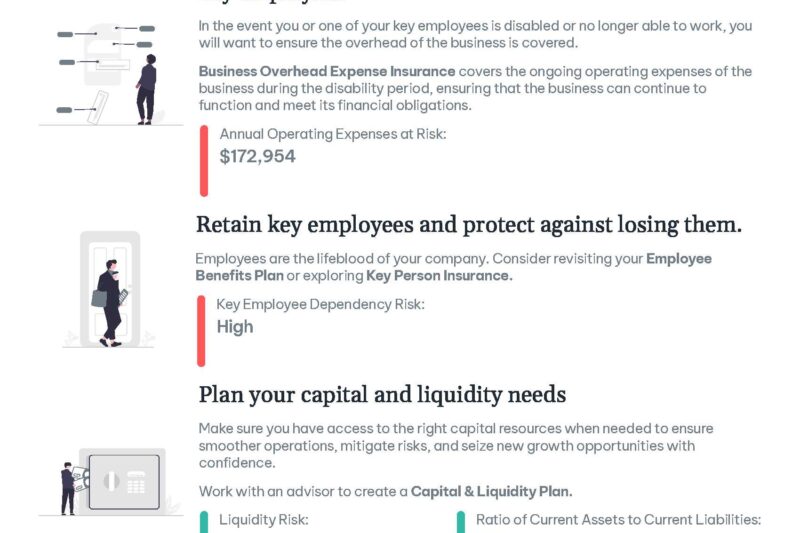

If you are a business owner or decision making executive, how would you want to design The Perfect Plan™ to retain and reward your employees? A 401K is terrific for basic retirement savings, but there are limitations to how much you can put in, and it must be given to everyone on a proportional basis.

In this episode, we discuss the decision making process, how you can get the perfect timing of your deductions, and include the people and benefits that are needed most, in the most tax efficient manner. No two companies are alike, and neither should your plans be.

Come and listen to this podcast as we lay it out for you.

https://youtu.be/iaauDbaRHa8

It's the beginning of December, and as a business owner, timing your deductions to match your revenue, is at the top of your goals that we here from our clients. In this episode, I quickly cover some of the deductions that you should think about both before, or after, the end of the year. If you haven't set up your "Perfect Plan", now is the time.

In my latest interview with key people in the financial services world, I had the pleasure to hear from my friend Ali Nasser as he explained his history of working with business owners and their "dilemmas". We chatted about our friendship, history, and how he decided to write his book where you'll learn that you aren't alone in how you run your business, what you prioritize, and what you think about. He has spoken nationwide about this topic, and you can learn more by accessing his book through this link:

If you'd like to purchase his book, please use the following link:

https://www.amazon.com/Business-Owners-Dilemma-Control-Chatter/dp/1544501463

Through his stories, he'll help you gain clarity of what is most important to you, and help you lay out a plan for your "ideal" situation.

Start your own valuation here:

P.S. SEB does not make any money on the sales of this book, and 100% of the proceeds from his book go to Charity (Water). We hope that you enjoy what it offers you, and that if you find value, we would be happy to help you Clarify your ideal Future.

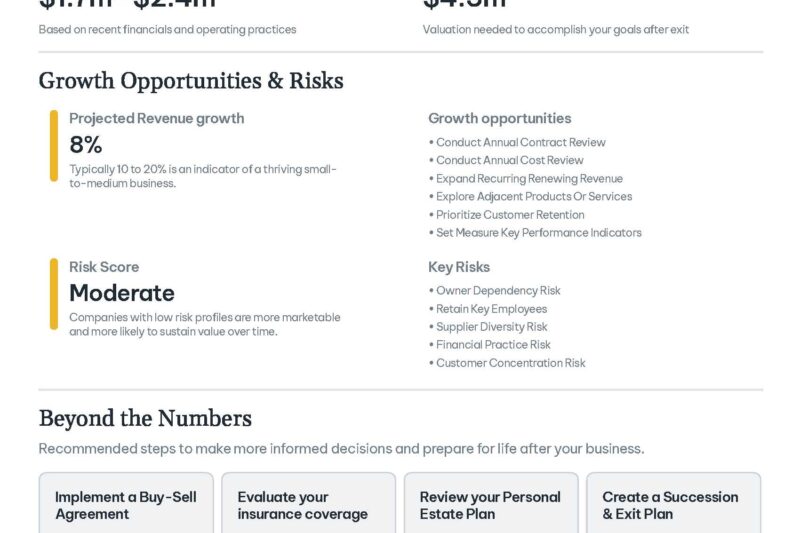

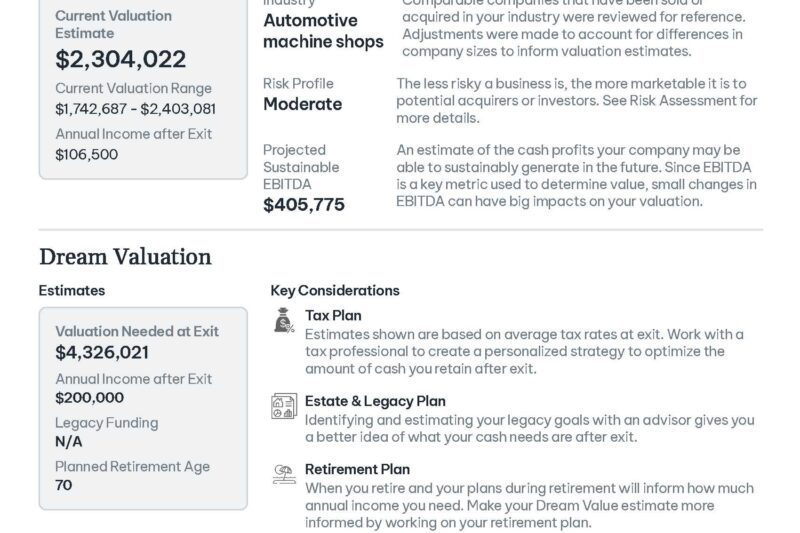

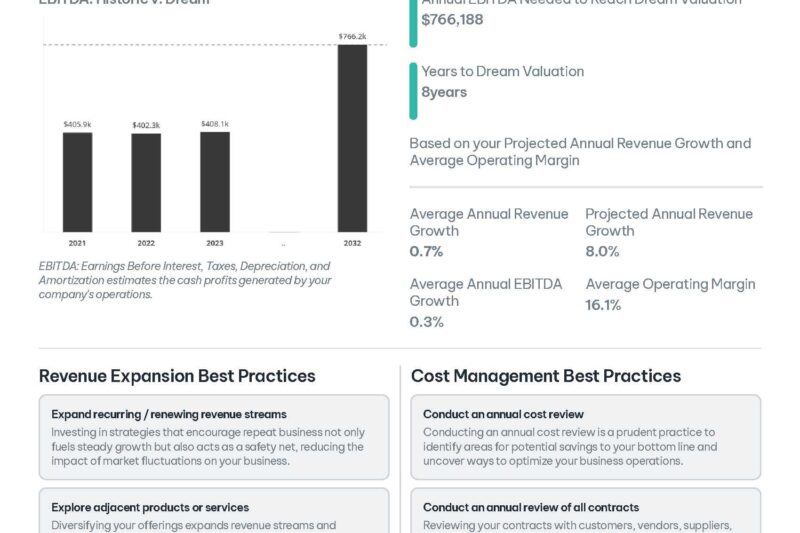

Every business owner starts their business with the intent to "sell it" sometime in the future, make a lump sum, and walk away. Most likely, if you are reading this, you're more than far enough along in your ownership journey that you are now asking yourself:

"How much is my business worth?".

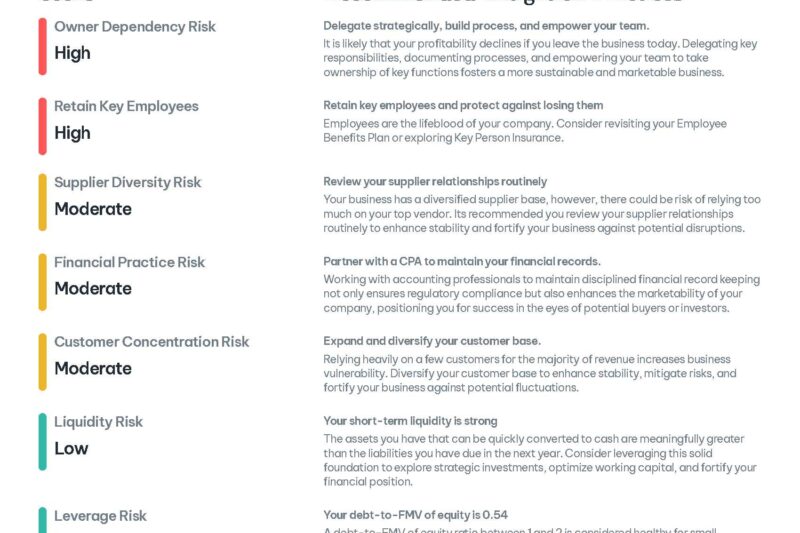

At Schiff Executive Benefits (SEB), we use a business valuation program called RISR that can help you find out. If you use Quickbooks, an owner can share their last three years of tax related data electronically, seamlessly, and securely through a link that we will send you to your PRIVATE valuation. After uploading that data, and answering a few questions about the operation of the business (i.e. ownership, tax structure, client concentration, operational questions, etc.), RISR will generate a SNAPSHOT value for SEB to review with you, so that you can realize your DREAM value in the future.

Using the results from the report, you can:

- Negotiate offers with potential buyers,

- Discuss with management ways to improve profitability

- Review potential business valuation risks, and

- Align your people with the future growth of the company.

Here were some of the solutions that our clients decided upon after engaging SEB:

- Sold to an outside party

- Implemented an Installment (structured) sale to the employees/family member

- Employee Stock Ownership Plans

- Sell some or ALL of your stock

- Retain Control of the company

- Immediate Tax Savings for an S Corp

- Provides Retention Strategy for ALL employees

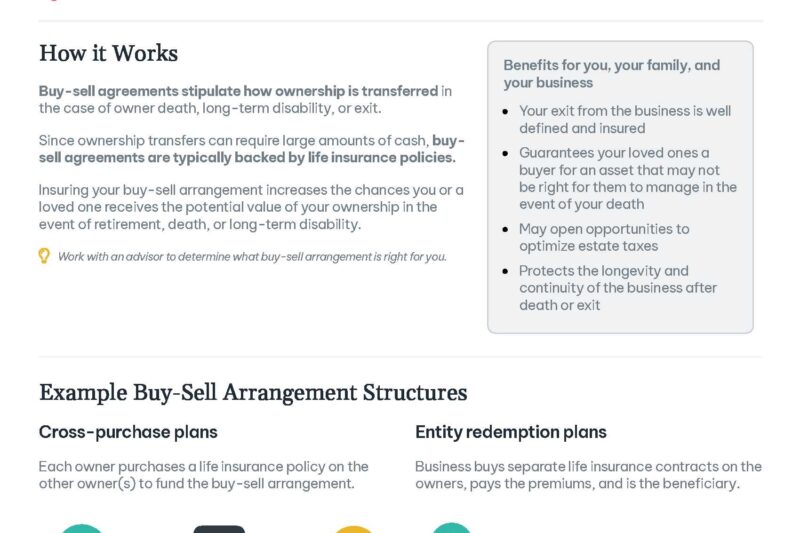

- Buy/Sell Planning Between Partners upon:

- Death

- Disability, or

- Retirement

- Tax Efficient Retention Strategies

- Executive Bonus

- Restricted Executive Bonus (REBA)

- Supplemental Retirement Plan

- Excess 401K Plans

- For YOUR report specific to YOUR company, Complete the form below to request your link for your business valuation.

A FULL sample report can be downloaded here: Schiff Auto report

In a PERFECT world, how would you design a "benefit" plan for you (the Business Owner), your key executives, and your family? Well, in this Episode, Matt goes through some design options available when starting a brand new plan. In essence, you have a blank piece of paper that allows you to build it YOUR way.

Sit back grab your coffee, and listen to some options available to you depending on your role.

https://youtu.be/VUsv8NaXsrc

Are you a business owner? Have you ever thought about selling your business? How much is it worth? Do you have other shareholders, or family that own part of the business?

Well, in this, the Sixth episode of The Perfect Plan, Dan Zugell, my friend and colleague of 25 plus years goes into the wonder of an Employee Stock Ownership Plan (ESOP). In this qualified retirement plan solution for a business owner, you have a ready and willing buyer, that will buy your business, for a set dollar amount, at a set triggering event. If done correctly, you as the business owner can still run it, control it, and participate in the future growth of your company.

Dan goes into the benefits, tax advantages, and rules of how to design "the perfect" exit strategy for the closely held business owner. Take a few minutes and hear what he has to say, then contact us on how we can help you monetize your largest asset.

Ps. You can schedule a direct call with Dan at https://dantheesopman.com/ or with SEB at Calendly - Matthew E Schiff