Every business owner starts their business with the intent to "sell it" sometime in the future, make a lump sum, and walk away. Most likely, if you are reading this, you're more than far enough along in your ownership journey that you are now asking yourself:

"How much is my business worth?".

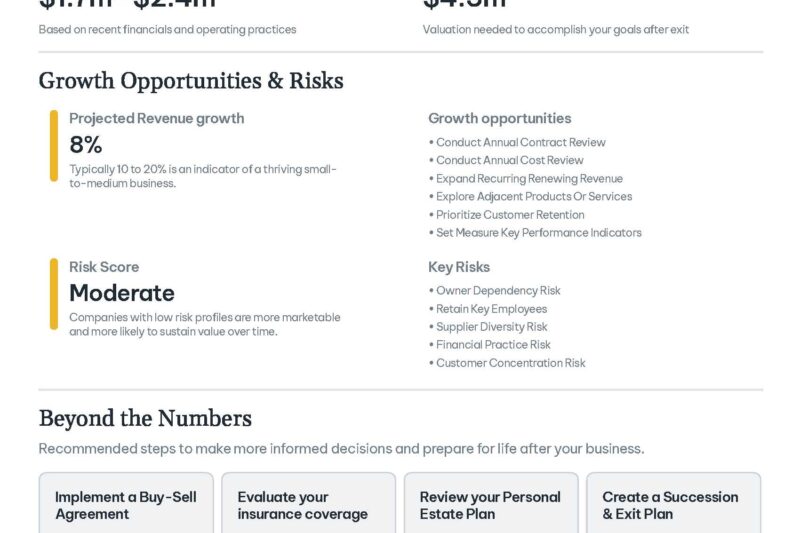

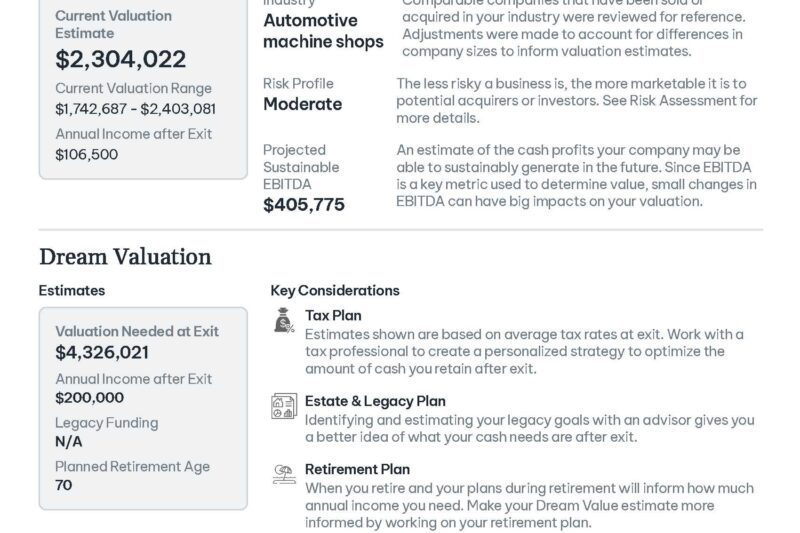

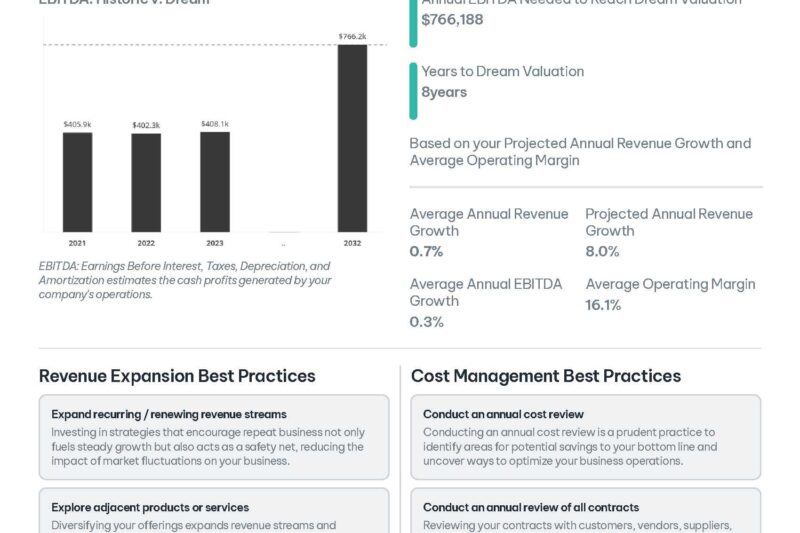

At Schiff Executive Benefits (SEB), we use a business valuation program called RISR that can help you find out. If you use Quickbooks, an owner can share their last three years of tax related data electronically, seamlessly, and securely through a link that we will send you to your PRIVATE valuation. After uploading that data, and answering a few questions about the operation of the business (i.e. ownership, tax structure, client concentration, operational questions, etc.), RISR will generate a SNAPSHOT value for SEB to review with you, so that you can realize your DREAM value in the future.

Using the results from the report, you can:

- Negotiate offers with potential buyers,

- Discuss with management ways to improve profitability

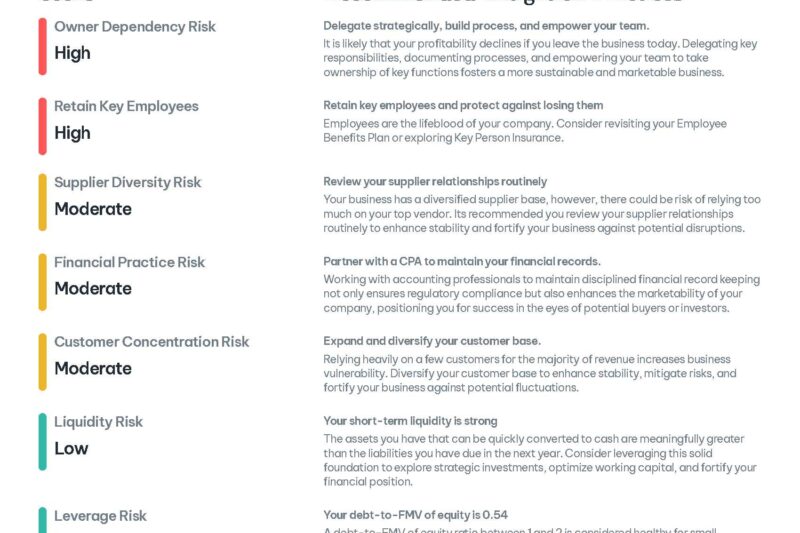

- Review potential business valuation risks, and

- Align your people with the future growth of the company.

Here were some of the solutions that our clients decided upon after engaging SEB:

- Sold to an outside party

- Implemented an Installment (structured) sale to the employees/family member

- Employee Stock Ownership Plans

- Sell some or ALL of your stock

- Retain Control of the company

- Immediate Tax Savings for an S Corp

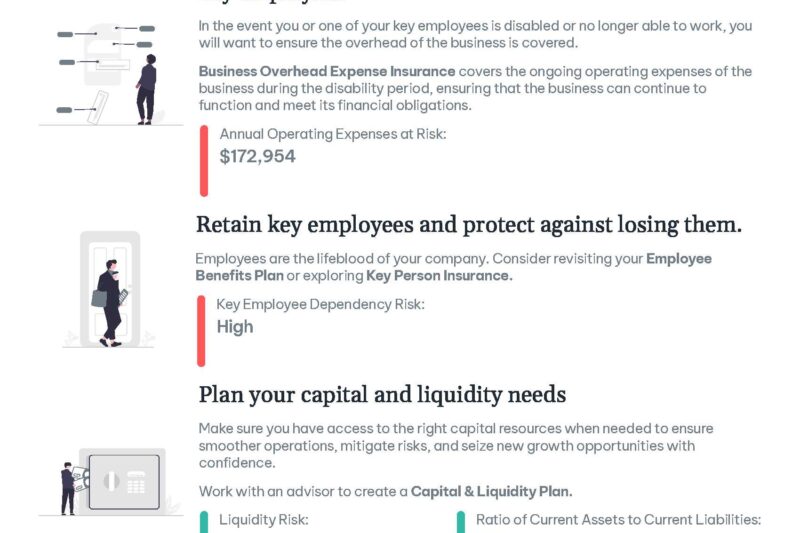

- Provides Retention Strategy for ALL employees

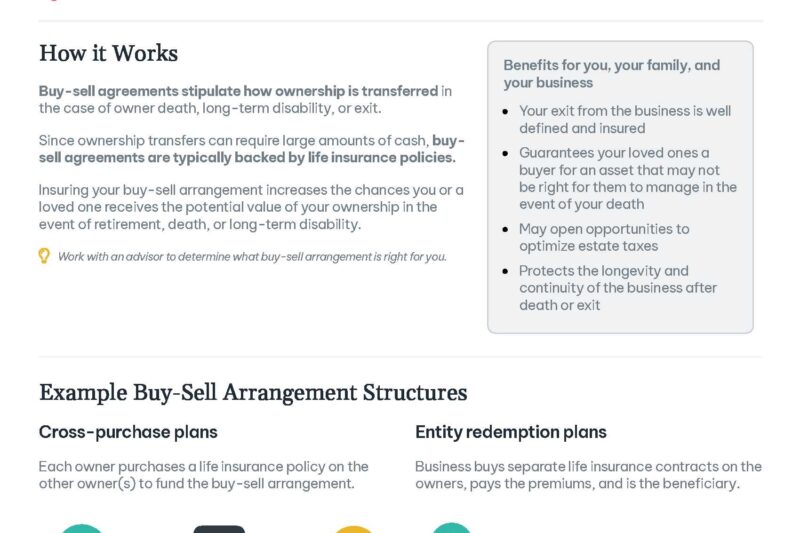

- Buy/Sell Planning Between Partners upon:

- Death

- Disability, or

- Retirement

- Tax Efficient Retention Strategies

- Executive Bonus

- Restricted Executive Bonus (REBA)

- Supplemental Retirement Plan

- Excess 401K Plans

- For YOUR report specific to YOUR company, Complete the form below to request your link for your business valuation.

A FULL sample report can be downloaded here: Schiff Auto report

Ever wanted the "perfect" plan where the company gets a current deduction when the money is paid into the plan, the cash grows tax deferred, and then the participant get the money "tax free"? Well look no further. There is a plan like that available. You just have to be willing to discriminate.

It's called a Restricted Executive Bonus plan and combines to different benefits in one. It has to be done carefully to meet IRS guidelines, but is 100% legal. Nice thing is, it's not carrier or product specific, and has the flexibility as to what type of asset you want in the plan.

To learn more, give us a call or check out our Executive Bonus material. We'd be happy to design a sample for you so that you keep your best people.