Every business owner starts their business with the intent to "sell it" sometime in the future, make a lump sum, and walk away. Most likely, if you are reading this, you're more than far enough along in your ownership journey that you are now asking yourself:

"How much is my business worth?".

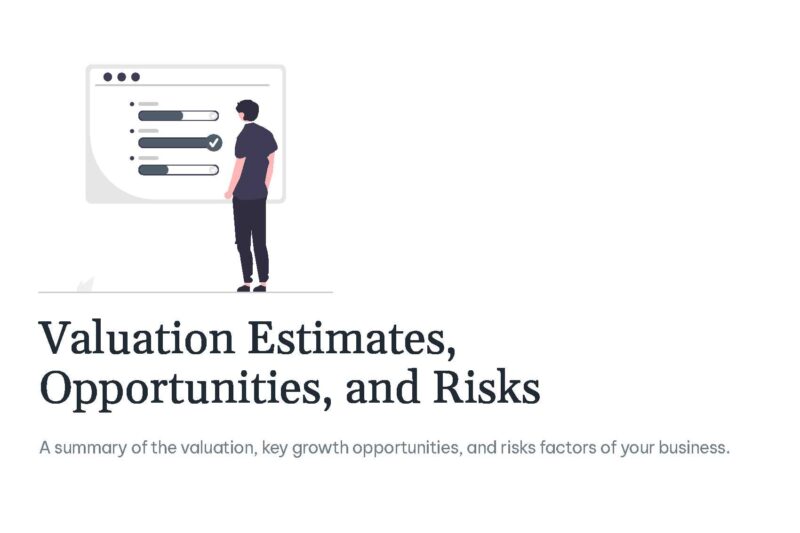

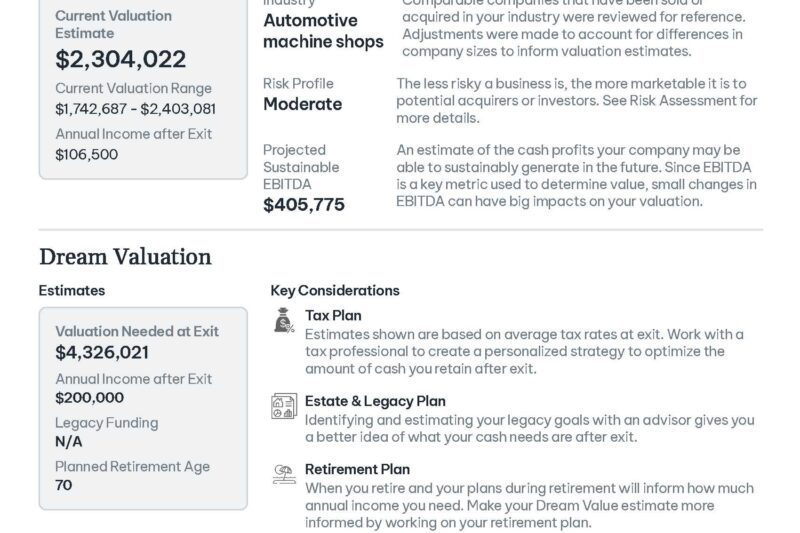

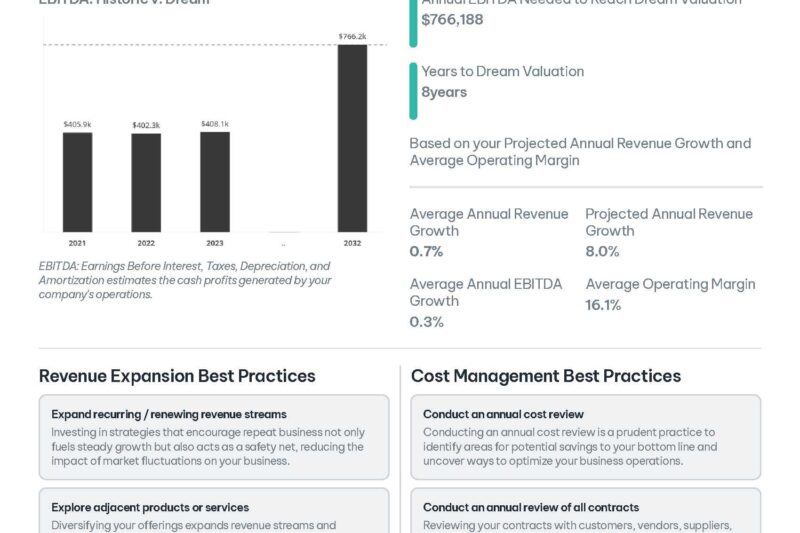

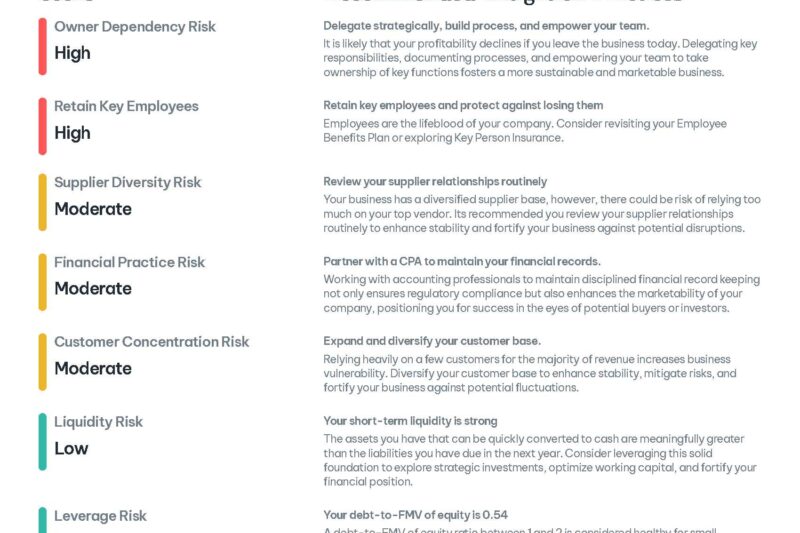

At Schiff Executive Benefits (SEB), we use a business valuation program called RISR that can help you find out. If you use Quickbooks, an owner can share their last three years of tax related data electronically, seamlessly, and securely through a link that we will send you to your PRIVATE valuation. After uploading that data, and answering a few questions about the operation of the business (i.e. ownership, tax structure, client concentration, operational questions, etc.), RISR will generate a SNAPSHOT value for SEB to review with you, so that you can realize your DREAM value in the future.

Using the results from the report, you can:

- Negotiate offers with potential buyers,

- Discuss with management ways to improve profitability

- Review potential business valuation risks, and

- Align your people with the future growth of the company.

Here were some of the solutions that our clients decided upon after engaging SEB:

- Sold to an outside party

- Implemented an Installment (structured) sale to the employees/family member

- Employee Stock Ownership Plans

- Sell some or ALL of your stock

- Retain Control of the company

- Immediate Tax Savings for an S Corp

- Provides Retention Strategy for ALL employees

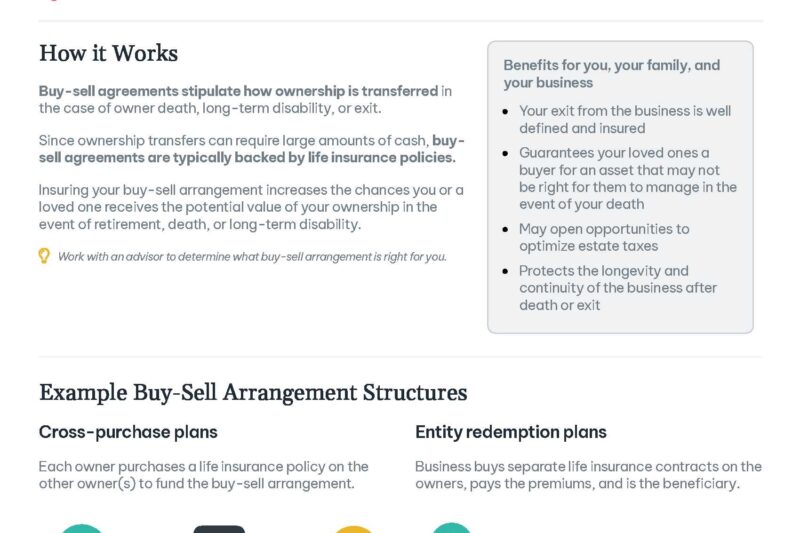

- Buy/Sell Planning Between Partners upon:

- Death

- Disability, or

- Retirement

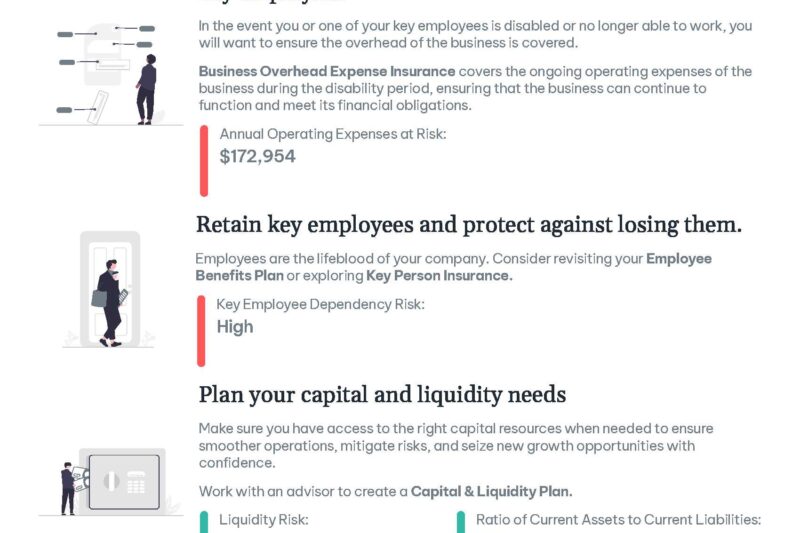

- Tax Efficient Retention Strategies

- Executive Bonus

- Restricted Executive Bonus (REBA)

- Supplemental Retirement Plan

- Excess 401K Plans

- For YOUR report specific to YOUR company, Complete the form below to request your link for your business valuation.

A FULL sample report can be downloaded here: Schiff Auto report

https://youtu.be/VUsv8NaXsrc

Are you a business owner? Have you ever thought about selling your business? How much is it worth? Do you have other shareholders, or family that own part of the business?

Well, in this, the Sixth episode of The Perfect Plan, Dan Zugell, my friend and colleague of 25 plus years goes into the wonder of an Employee Stock Ownership Plan (ESOP). In this qualified retirement plan solution for a business owner, you have a ready and willing buyer, that will buy your business, for a set dollar amount, at a set triggering event. If done correctly, you as the business owner can still run it, control it, and participate in the future growth of your company.

Dan goes into the benefits, tax advantages, and rules of how to design "the perfect" exit strategy for the closely held business owner. Take a few minutes and hear what he has to say, then contact us on how we can help you monetize your largest asset.

Ps. You can schedule a direct call with Dan at https://dantheesopman.com/ or with SEB at Calendly - Matthew E Schiff

In today's post COVID world, are you finding it hard to keep your best people happy, while making sure that you don't overpay the rank and file employees? Well maybe a Phantom Stock Plan, informally funded using key man life insurance, might be an answer.

Check out this sample program from one of our carriers, Guardian. It outlines these benefits in easy, simple to understand discussion pages, and then shows you the cash flow from the business, the benefits provided to the participant and his family in case of pre-retirement death, and the flexibility available to the company in funding this benefit, that, depending on the age and tenure of your employee, can provide a significant supplemental income at retirement that prevents them from leaving for a few extra thousand in compensation

Click on the following link for a copy of a Phantom Stock Sample. Then, if you'd like to a have a custom design done for you or your company, give us a call at 610.292.9330 or send us an email at info@SchiffBenefits.com.