https://youtu.be/xCJa6nq6qb8

Are you a Business Owner? Are you an accountant who works with business owners? Are you trying to figure out how much your business is worth, or better yet, are your trying to plan your exit strategy?

Then you want to hear from Jason and Corey about how RISR can help the business owner monetize his/her largest asset.

If you'd like to know your business value, click below to start your Business Valuation:

Start your own Business Valuation here

In this episode of the Perfect Plan™ podcast, Matt welcomes welcome Holland Haiis as our special guest! Holland is a renowned workplace strategist, speaker, and author who helps individuals and organizations boost productivity, improve communication, and unlock human potential. Known as the "Digital Detox Coach," Holland empowers people to thrive by balancing the digital demands of today's world with intentional human connection. In this episode, Holland and Matt dive deep into creating a Perfect Plan™ for leadership, communication, and living a more connected life — both online and offline. Trust me, this conversation is packed with insights you can apply right away!

Learn More About Holland: https://www.hollandhaiis.com/

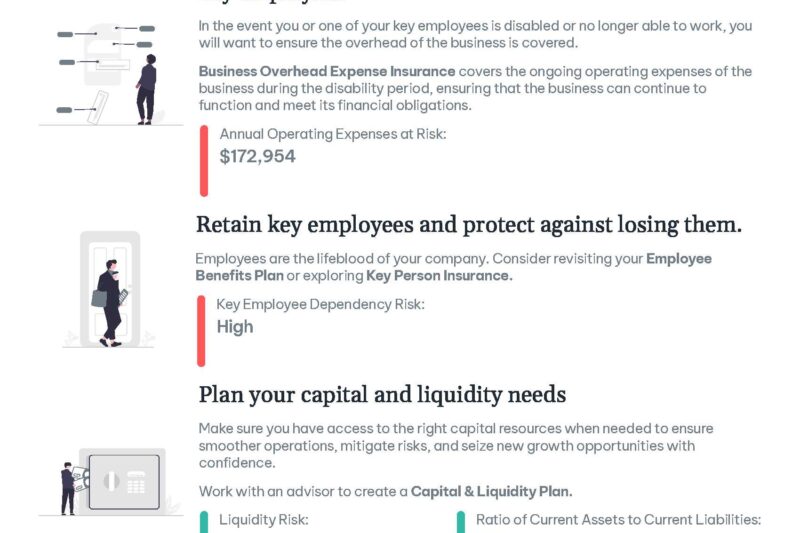

If you are a business owner or decision making executive, how would you want to design The Perfect Plan™ to retain and reward your employees? A 401K is terrific for basic retirement savings, but there are limitations to how much you can put in, and it must be given to everyone on a proportional basis.

In this episode, we discuss the decision making process, how you can get the perfect timing of your deductions, and include the people and benefits that are needed most, in the most tax efficient manner. No two companies are alike, and neither should your plans be.

Come and listen to this podcast as we lay it out for you.

https://youtu.be/jKzJWj8SbRQ

Are you a fan of Arli$$ the TV Show? Do you remember what the premise was? It was about a glitzy sports agent played by Robert Wuhl who is in the big-money world of professional sports and entertainment, playing the eternally optimistic and endlessly resourceful L.A. sports agent Arliss Michaels, whose Achilles' heel is his inability to say "no" to clients and employees.

In this episode, we have the pleasure of sitting down with the man that the show was based off of, Dennis Gilbert of Paradigm Gilbert (a Higgenbothom Partner), as he goes into how Bobby Bonilla came about, what it was like to get started in the insurance industry, his stint in baseball and how he brought his passion for the game together with the financial services world.

https://youtu.be/iaauDbaRHa8

It's the beginning of December, and as a business owner, timing your deductions to match your revenue, is at the top of your goals that we here from our clients. In this episode, I quickly cover some of the deductions that you should think about both before, or after, the end of the year. If you haven't set up your "Perfect Plan", now is the time.

In my latest interview with key people in the financial services world, I had the pleasure to hear from my friend Ali Nasser as he explained his history of working with business owners and their "dilemmas". We chatted about our friendship, history, and how he decided to write his book where you'll learn that you aren't alone in how you run your business, what you prioritize, and what you think about. He has spoken nationwide about this topic, and you can learn more by accessing his book through this link:

If you'd like to purchase his book, please use the following link:

https://www.amazon.com/Business-Owners-Dilemma-Control-Chatter/dp/1544501463

Through his stories, he'll help you gain clarity of what is most important to you, and help you lay out a plan for your "ideal" situation.

Start your own valuation here:

P.S. SEB does not make any money on the sales of this book, and 100% of the proceeds from his book go to Charity (Water). We hope that you enjoy what it offers you, and that if you find value, we would be happy to help you Clarify your ideal Future.

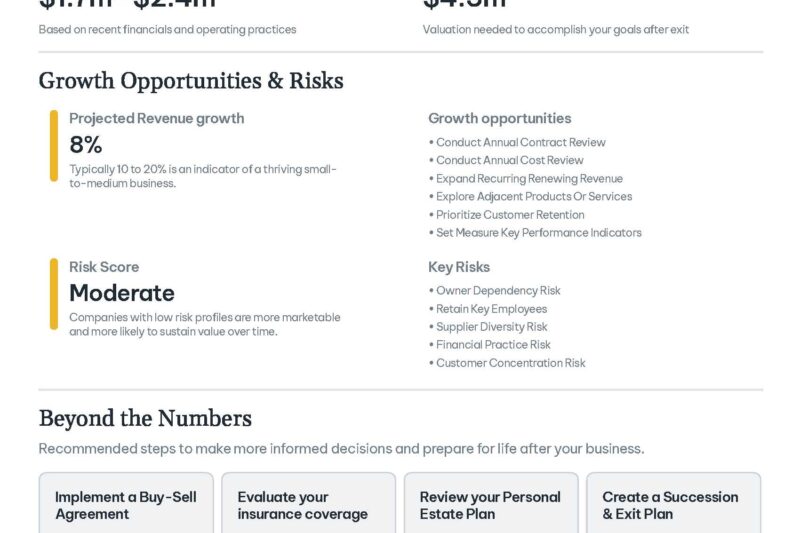

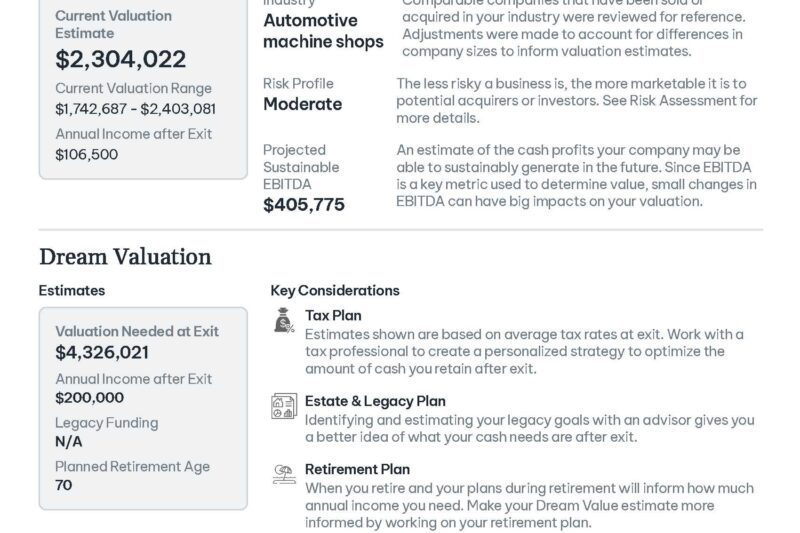

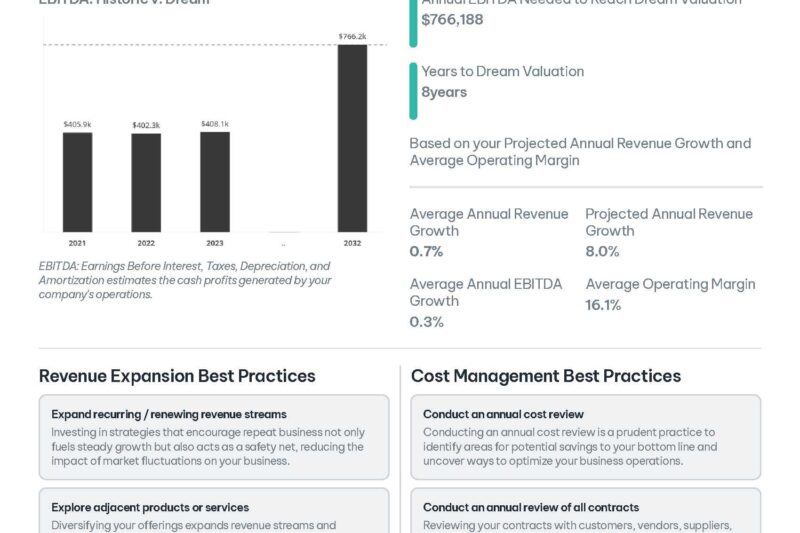

Every business owner starts their business with the intent to "sell it" sometime in the future, make a lump sum, and walk away. Most likely, if you are reading this, you're more than far enough along in your ownership journey that you are now asking yourself:

"How much is my business worth?".

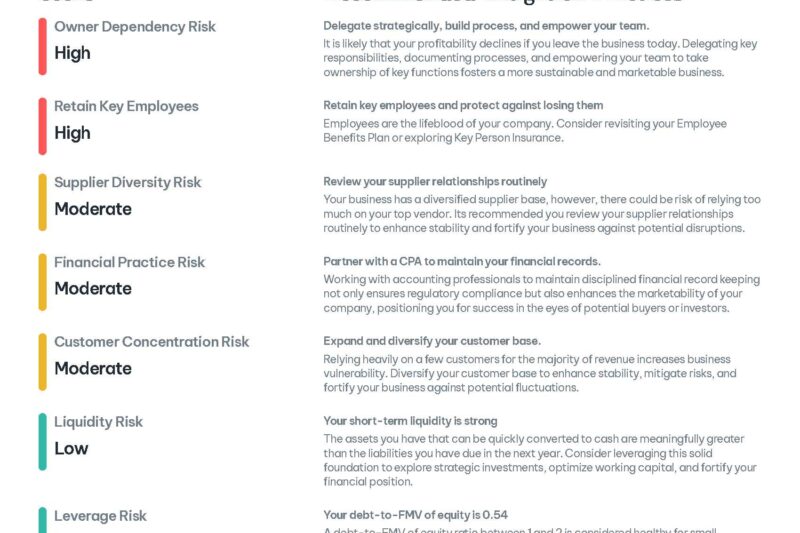

At Schiff Executive Benefits (SEB), we use a business valuation program called RISR that can help you find out. If you use Quickbooks, an owner can share their last three years of tax related data electronically, seamlessly, and securely through a link that we will send you to your PRIVATE valuation. After uploading that data, and answering a few questions about the operation of the business (i.e. ownership, tax structure, client concentration, operational questions, etc.), RISR will generate a SNAPSHOT value for SEB to review with you, so that you can realize your DREAM value in the future.

Using the results from the report, you can:

- Negotiate offers with potential buyers,

- Discuss with management ways to improve profitability

- Review potential business valuation risks, and

- Align your people with the future growth of the company.

Here were some of the solutions that our clients decided upon after engaging SEB:

- Sold to an outside party

- Implemented an Installment (structured) sale to the employees/family member

- Employee Stock Ownership Plans

- Sell some or ALL of your stock

- Retain Control of the company

- Immediate Tax Savings for an S Corp

- Provides Retention Strategy for ALL employees

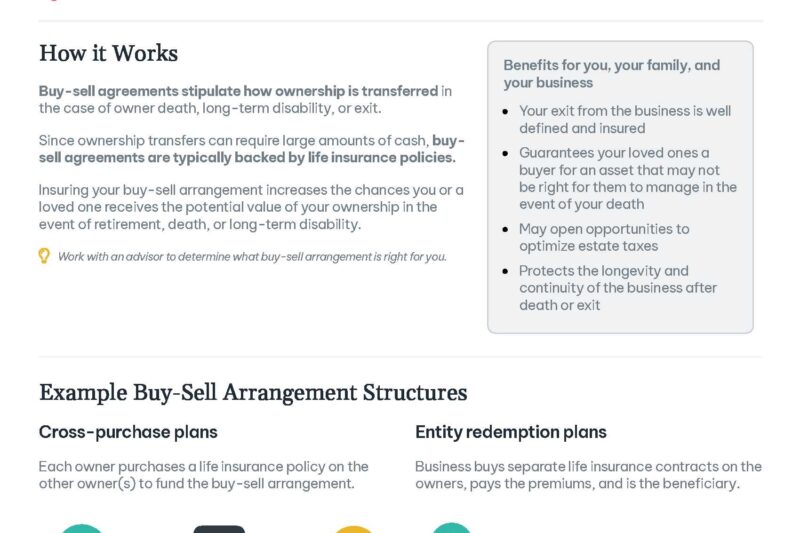

- Buy/Sell Planning Between Partners upon:

- Death

- Disability, or

- Retirement

- Tax Efficient Retention Strategies

- Executive Bonus

- Restricted Executive Bonus (REBA)

- Supplemental Retirement Plan

- Excess 401K Plans

- For YOUR report specific to YOUR company, Complete the form below to request your link for your business valuation.

A FULL sample report can be downloaded here: Schiff Auto report

In a PERFECT world, how would you design a "benefit" plan for you (the Business Owner), your key executives, and your family? Well, in this Episode, Matt goes through some design options available when starting a brand new plan. In essence, you have a blank piece of paper that allows you to build it YOUR way.

Sit back grab your coffee, and listen to some options available to you depending on your role.