As a financial advisor of over 34 years, where I grew up at the kitchen table listening to BOTH of my parents discuss their day at work, I learned the “basics” of finance at a very young age. Some would even say, “he couldn’t run fast enough to get away from it”.

So how can the knowledge shared over the kitchen table by two of the smartest financial people I’ve known in my life help you? Well, first off, if you haven’t had the chance to listen to “The Perfect Plan” podcast on YouTube hosted by Matt Schiff and Schiff Benefits, then you have missed out on incredible “wisdom” from financial services industry wizards from all sides of the financial services world. Hear from experts like:

- Tom Hegna (Former SVP of NYL Annuity Division)

- Jamie Hopkins (Preisdent of Bryn Mawr Trust Advisors)

- Joe Jordan (Living a Life of Significance Author)

- Bud Schiff (Managin Director Alvarex and Marsal)

- Dan Zugell (SVP of BTA Advisors)

- Lindsay Hanson (VP of JH Vitality)

- Ali Nassar (Business Person’s Dilemna)

https://www.youtube.com/@SchiffExecutiveBenefits/videos

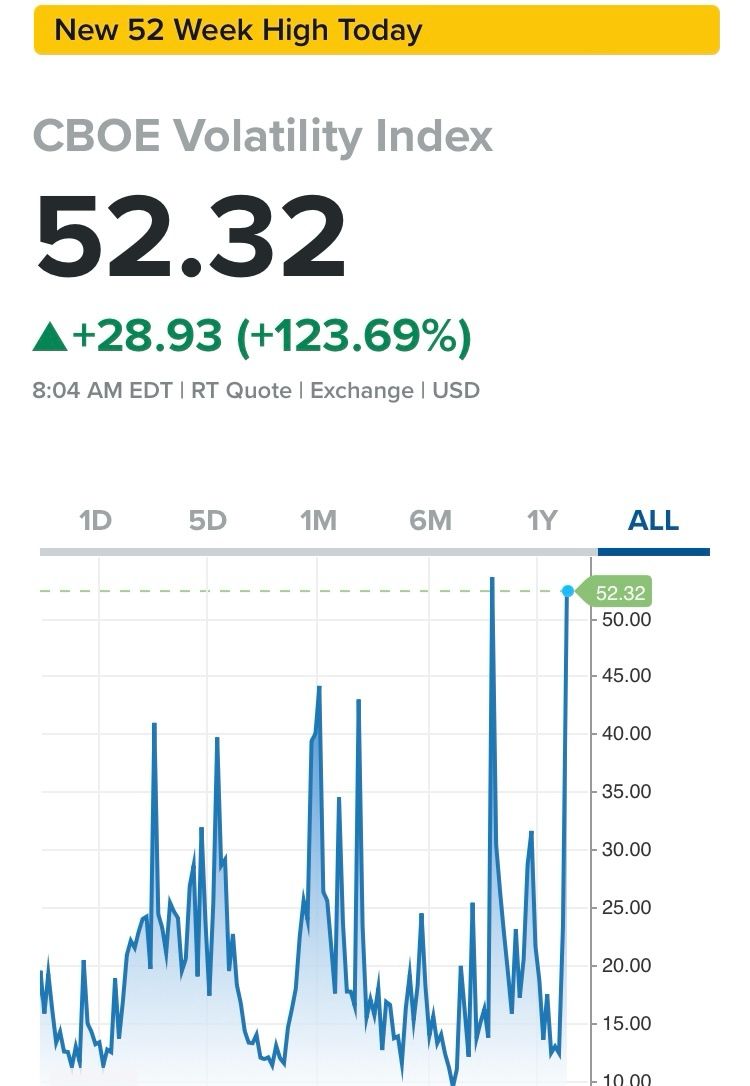

But forget the podcast, if the market is down 5% – 10% in the last week… I am running around like Chicken Little – Protect Me. Your retirement assets are at risk, you may be close to, or in retirement, and can’t afford a market downturn with a POTENTIAL recovery. You need income, you need security, and a correction has a material impact on you. How can I LOCK IN my value today, the income potential, while also getting upside potential? Questions, more questions, and where can I find the answers?

So, what should I do? Sell? Buy and hope that I caught the bottom? Truth is, it’s not the investors job to TIME the markets. At the same time, you shouldn’t “blindly” give money managers money. But is SHOULD be aligned with being able to put your HEAD ON THE PILLOW every night, and being able to sleep comfortably, no matter if it goes up or down.

At Schiff Executive Benefits we aren’t market timers. We don’t claim to know one industry over another, or say you’ll get X amount of return. What we DO KNOW is that after a combined 80+ years of experience, we listen to what you want to accomplish, formulate a plan, and help you execute it with a formal review to stay on track. There are ways to PROTECT your downside market risks while also participating in the upside potential, both in pre- and post-retirement years. It all depends on your risk/reward levels. A younger individual can afford more risk and as you get older, you should try to manage that downside risk, with strategies that FIT YOUR GOALS. Let SEB help you define and achieve your goals.

If this aligns with your feelings, goals, and risk strategy, then email us at info@schiffbenefits.com to start your journey. Our advisors will help you create a strategy with YOUR goals in mind.

#StockMarket #Retirement #Alternatives #Income #Protection #Goals #HeadonPillow